Federal Reserve Still Pauses Interest Rate Cuts As They Forecast Inflation Not Going Away, Trump Policies Cause Confusion

Yesterday the Federal Reserve once again held interest rates at 4.0% for March, but made it known that inflation is will be returning and monetary policy moving forward is unclear due to the unpredictability of President Donald Trump’s economic policies, particularly in regard to tariffs and foreign sanctions.

In a statement, the Fed’s Federal Open Market Committee (FOMC) wrote:

Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty around the economic outlook has increased. The Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. Beginning in April, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion. The Committee will maintain the monthly redemption cap on agency debt and agency mortgage-backed securities at $35 billion. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

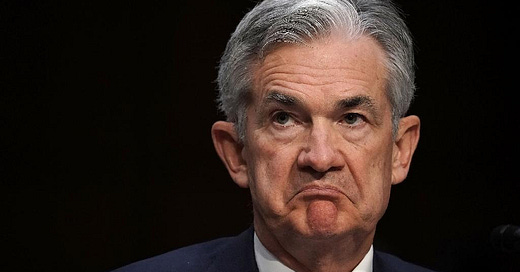

During Fed Chair Jerome Powell’s press conference, Powell indicated that the Fed is still eying at least two 25 basis point cuts this year, even though they admit little to no progress will be made on inflation. Powell stated there is a “high-level of uncertainty,” referring to Trump’s policies.

Powell’s rhetoric indicates that even though they don’t plan on making any progress in slowing the pace of inflation, they also see the potential for increased layoffs and the overall economy will weaken, therefore justifying the potential for rate cuts.

Powell also tried to that the U.S. has a “pretty good economy,” but Americans don’t agree because their grocery bills and other costs of living expenses are so high, though Powell says that was because of dramatic price increases from the several years and not is reflective of the current state of the economy.

ClearValue Tax highlights some of the salient points from Powell’s meeting:

AUTHOR COMMENTARY

Of course, this is the same clown (Powell), along with former Treasury Secretary Janet Yellen (who used to be the Fed Chair herself) who tried to sell us that inflation was “transitory.” Remember that nonsense?

Like I say pretty much every time, Powell and the Feds are liars. Everything they say is a half-truth and hyperbole. Everyone knows the economy is destroyed including them, but they can’t say that either.

The reality is I would expect rate cuts a few times at least, even if it makes zero sense to do so. Trump loves zero percent rates and he will continue to demand that we get there, whereas we need high interest rates to return some level of purchasing power to consumers while preventing banks and corporations from getting cheap money.

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.