On Cue: Trump Blasts Powell And The Federal Reserve For Not Cutting Interest Rates, Remains Steady At 4.0%

Get ready for more soap opera drama and bickering to come.

Yesterday the Federal Reserve expectedly held interest rates steady at 4.0% for January, and once again gave vague statements about what their actions will be moving forward. The Fed’s non-action irritated President Trump, who has demanded that the Fed make steep interest rate cuts.

In a statement, the Fed’s Federal Open Market Committee (FOMC) wrote:

Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

During his press conference, Federal Reserve Chair Jerome Powell said they are “in no hurry” to lower rates with the economy and monetary policy in “a very good place.” He claimed that although “significant progress” in reducing inflation has been made, Powell said the Fed wants to to see “further progress” in reducing inflation to the Fed’s 2% target, although Powell did say the emergence of unexpected weakness in the labor market could cause the FOMC to ease sooner.

ClearValue Tax provided additional highlights in a short update:

President Donald Trump told a panel at the World Economic Forum last week that he would call upon the Fed to lower interest rates pronto. Trump said:

With oil prices going down, I’ll demand that interest rates drop immediately. And, likewise, they should be dropping all over the world. Interest rates should follow us.

The WinePress has previously reported that Trump is a major proponent of low and even negative interest rates.

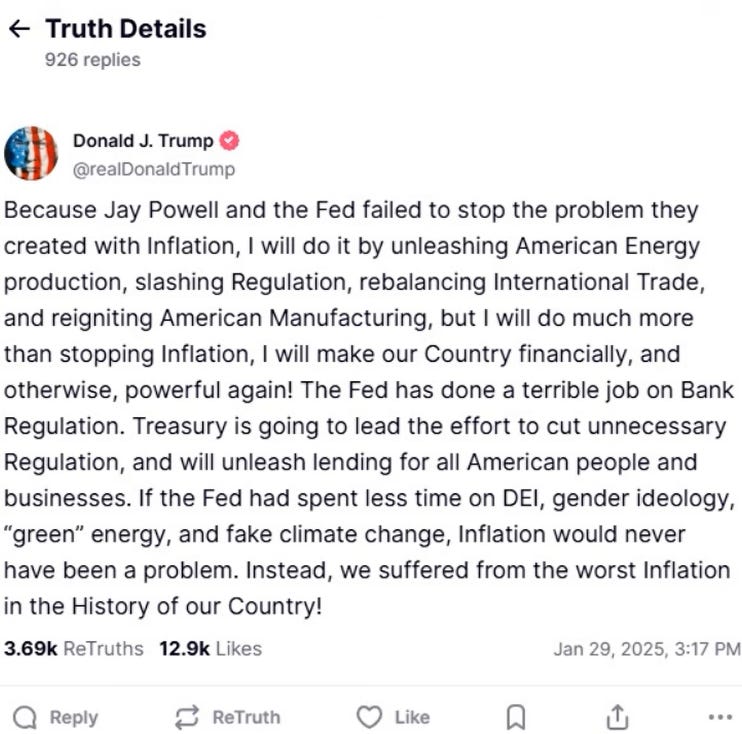

Predictably, Trump blasted Powell for not lowering rates. He claims that he will take matters into his own hands to reduce inflation in other ways such as increasing energy production. He went on to blame the Fed for, apparently, spending time and money on “DEI, gender ideology, “green” energy, and fake climate change.”

AUTHOR COMMENTARY

Trump’s so-called plans to lower inflation are simply nonsense and are not going to happen. His claims of increased energy output, for example, are what he proposed on the campaign trail; but he and Republicans completely ignore the glaring fact that oil and LNG production and profits tripled under Biden, and yet inflation continued to tick up and remain persistent, or, as the Fed and mainstream shills love to say, “sticky.”

So, these are just empty and frankly baseless promises and accusations, but he must play his part in getting the MAGA base to cheer for lower interest rates, not even realizing that lower rates weaken the purchasing power of the dollar, thereby creating inflation anyways, alongside the fact that lower rates only benefit the corporate agenda because their borrowing costs are reduced, and it requires more devalued dollars to purchase their products and services, thereby pushing up their stock valuations.

My commentary remains the same as stated on Monday:

I mention Trump’s recent calls to lower interest rates because I ultimately think that is going to happen in the long term, by hook or by crook. We’ll see how it plays out, but we understand that the data we get is fake and not to be taken all too seriously anyways;

But assuming the Fed does not cut this week, it will create the perfect soap opera drama for Trump to go calling Powell a “bonehead” again, and shout from the rooftops why we need lower rates, and get his MAGA base to cheer for lower rates (having no idea what they’re supporting and why, other than because Trump said it), and eventually will result in lower rates; not because of “Trump’s tough negotiations,” but because the ultimate goal by the Federal Reserve and central banks is to inflate: this brings the world closer to the new system of tokenized assets and CBDCs.

BlackRock has said as much outright in 2019, where they explicitly called for helicopter money and inflation to justify the transition into digital assets.

Proverbs 11:18 The wicked worketh a deceitful work: but to him that soweth righteousness shall be a sure reward.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

" . . . thereby pushing up their stock valuations."<----BINGO!