Trump Slaps First Round Of Tariffs Against China, Mexico And Canada. Mexico And Canada Respond With Their Own Tariffs

Levying a tariff on a good increases its cost for businesses and consumers, the Tax Policy Center warns.

After many threats and warnings on the campaign trail to levy tariffs on a number of different countries, President Trump today announced the first wave of tariffs against China, Mexico and Canada, with most of the emphasis placed on Mexico, blamed for the immigration and drug crisis in the United States. Mexico immediately responded with its own tariffs against the U.S.

Investopedia defines a tariff as “a tax imposed by one country on the goods and services imported from another country to influence it, raise revenues, or protect competitive advantages.” It also lists some criticisms of implementing tariffs:

They can make domestic industries less efficient and innovative by reducing competition.

They can hurt domestic consumers since a lack of competition tends to push up prices.

They can generate tensions by favoring specific industries or geographic regions over others. For example, tariffs designed to help manufacturers in cities may hurt consumers in rural areas who do not benefit from the policy and are likely to pay more for manufactured goods.

Finally, an attempt to pressure a rival country by using tariffs can devolve into an unproductive cycle of retaliation, commonly known as a trade war.

In other words, the importer (U.S. companies in this case) pay the additional fees.

Via executive order, “Trump is implementing a 25% additional tariff on imports from Canada and Mexico and a 10% additional tariff on imports from China. Energy resources from Canada will have a lower 10% tariff.”

The Trump White House provided its reasons for the tariffs:

The extraordinary threat posed by illegal aliens and drugs, including deadly fentanyl, constitutes a national emergency under the International Emergency Economic Powers Act (IEEPA).

President Trump is taking bold action to hold Mexico, Canada, and China accountable to their promises of halting illegal immigration and stopping poisonous fentanyl and other drugs from flowing into our country.

The orders make clear that the flow of contraband drugs like fentanyl to the United States, through illicit distribution networks, has created a national emergency, including a public health crisis. Chinese officials have failed to take the actions necessary to stem the flow of precursor chemicals to known criminal cartels and shut down money laundering by transnational criminal organizations.

In addition, the Mexican drug trafficking organizations have an intolerable alliance with the government of Mexico. […]

Access to the American market is a privilege. The United States has one of the most open economies in the world, and the lowest average tariff rates in the world.

While trade accounts for 67% of Canada’s GDP, 73% of Mexico’s GDP, and 37% of China’s GDP, it accounts for only 24% of U.S. GDP. However, in 2023 the U.S. trade deficit in goods was the world’s largest at over $1 trillion.

President Trump promised in November to “sign all necessary documents to charge Mexico and Canada a 25% Tariff on ALL products coming into the United States, and its ridiculous Open Borders. This Tariff will remain in effect until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!”

On the campaign trail, Trump emphasized his love for tariffs, as noted by The WinePress. “I can’t believe how many people are negative on tariffs that are actually smart,” Trump says. “Man, is it good for negotiation. I’ve had guys, I’ve had countries that were potentially extremely hostile coming to me and saying, ‘Sir, please stop with the tariff stuff.’”

Trump even hinted at hefty tariffs of 60% to 100% levied against China. He also has toyed with the idea of a 100% tariff on Mexican goods. reported Trump has also threatened 100% tariffs on BRICS+ members.

The Tax Policy Center (TPC) reported in a detailed presentation in October that both President Trump and Biden had increased their reliance on tariffs, but noted that Trump’s proposals at the time would increase the prices of imported goods.

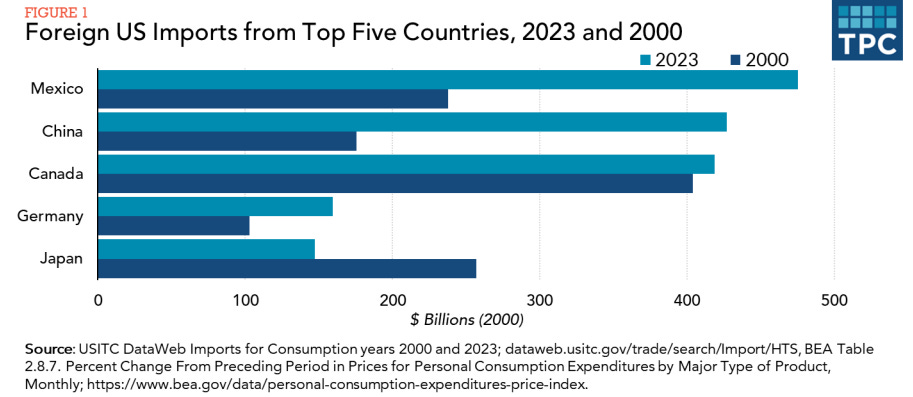

In 2023, the US imported $3.1 trillion in goods from other nations. The top five importers to the US were Mexico, China, Canada, Germany, and Japan. Combined, these five countries accounted for roughly half of all goods the US imported that year. The US imported the most goods from Mexico ($475 billion), followed closely by China ($427 billion) and Canada ($419 billion).

The sixth through tenth countries in terms of most imported goods were South Korea, Vietnam, Taiwan, India, and Ireland. The US imported at least $80 billion from each of these nations.

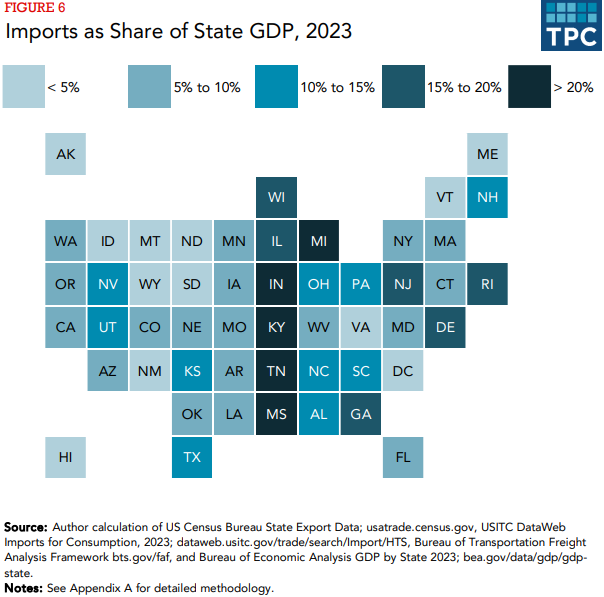

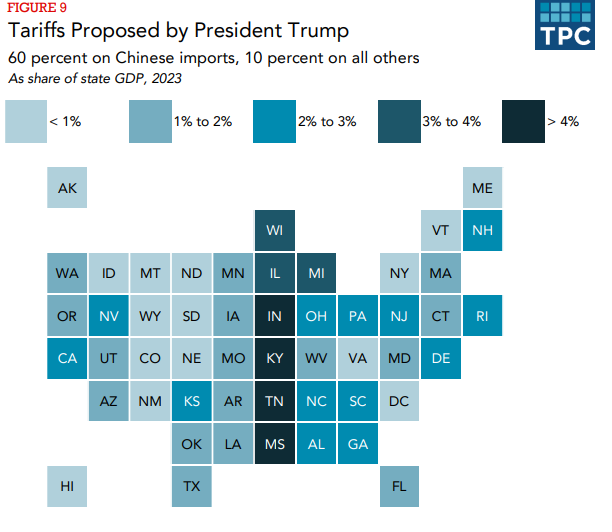

If some of these very heavy-handed tariffs are implemented, the TPC says, “Trump’s proposal would increase tariff payments as a share of state GDP, on average, by 1.5 percentage points across the 50 states and the District of Columbia. The largest increases would occur in Kentucky (4.1 points), Indiana (3.9 points), Tennessee (3.6 points), Mississippi (3.5 points), and Michigan (2.8 points).”

In short, the TPC concluded:

The US has not collected a significant amount of revenue from tariffs since it enacted an income tax in the early 20th century.

If Trump levied the 60 percent and 10 percent tariffs, it would significantly increase tariff payments relative to state GDP in states across the nation.

Levying a tariff on a good increases its cost for businesses and consumers. Past arguments for accepting these higher costs have included prompting nascent industries in the US, protecting jobs in important sectors, and national security reasons. Trump’s expanded tariffs would create a new policy tradeoff calculation, and the costs of that policy would not be spread equally across the 50 states.

In response to the tariffs, the Chinese Xinhua News Agency reported:

‘Chinese Foreign Ministry spokesperson Mao Ning emphasized that China has always maintained that there are no winners in a trade war or tariff war, and the country remains steadfast in safeguarding its national interests. Spokesperson for the Ministry of Commerce He Yadong has said China's position on the tariff issue is consistent. Tariff measures are not conducive to the interests of either China or the United States, nor to the rest of the world, He said.’

Chinese state media Global Times reported it will file a lawsuit with the World Trade Organization (WTO) for Trump’s actions. “China urges the US to correct its erroneous practices, meet the Chinese side halfway, confront issues directly, engage in candid dialogue, strengthen cooperation, and manage differences based on equality, mutual benefit, and respect, according to the ministry,” the outlet reported.

Ultimately, China is not discouraged by these tariffs. Not long after Trump was elected in November, Liu Xueliang, general manager for APAC auto sales division at BYD, one of the world's largest EV makers, remarked that these tariffs would only harm the U.S., saying they only “disadvantage consumers.”

“The tariff policies ultimately harm consumers, not us. BYD will still endeavor to offer quality products at reasonable prices in all countries based on their own tariff guidelines.”

Mexico has also quickly responded to Trump with its own tariffs. Mexican President Claudia Sheinbaum said on Saturday she had ordered her economy minister to implement tariff and non-tariff measures to defend her country's interests, Reuters reported. In a lengthy post on X, she rebutted Trump’s tariffs, stating:

We categorically reject the White House's slander against the Mexican government of having alliances with criminal organizations, as well as any intention of intervention in our territory.

If such an alliance exists anywhere, it is in the United States armories that sell high-powered weapons to these criminal groups, as demonstrated by the United States Department of Justice itself in January of this year.

In four months, our government has seized more than 40 tons of drugs, including 20 million doses of fentanyl. It has also arrested more than ten thousand people linked to these groups.

If the United States government and its agencies wanted to address the serious consumption of fentanyl in their country, they could, for example, combat the sale of narcotics on the streets of their main cities, which they do not do, and the money laundering generated by this illegal activity that has done so much harm to their population.

They could also start a massive campaign to prevent the consumption of these drugs and take care of their young people, as we have done in Mexico. Drug consumption and distribution is in their country and that is a public health problem that they have not addressed. In addition, the synthetic opioid epidemic in the United States has its origin in the indiscriminate prescription of drugs of this type, authorized by the Food and Drug Administration (FDA), as demonstrated by the lawsuit against a pharmaceutical company.

Mexico does not want confrontation. We start from collaboration between neighboring countries. Mexico not only does not want fentanyl to reach the United States, but anywhere. Therefore, if the United States wants to combat criminal groups that traffic drugs and generate violence, we must work together in an integrated manner, but always under the principles of shared responsibility, mutual trust, collaboration and, above all, respect for sovereignty, which is not negotiable. Coordination, yes; subordination, no.

To this end, I propose to President Trump that we establish a working group with our best public health and security teams.

Problems are not resolved by imposing tariffs, but by talking and dialoguing, as we did in recent weeks with your State Department to address the phenomenon of migration; in our case, with respect for human rights.

The graph that President Trump has been posting on social media about the decline in migration was created by my team, which has been in constant communication with his.

I instruct the Secretary of Economy to implement Plan B that we have been working on, which includes tariff and non-tariff measures in defense of Mexico's interests.

Nothing by force; everything by reason and right.

Canada also responded with its own tariffs of 25% on $155 billion worth of goods “in response to the unjustified and unreasonable tariffs,” the Canadian Department of Finance said in a media release. It added:

These countermeasures have one goal: to protect and defend Canada’s interests, consumers, workers, and businesses.

The first phase of our response will include tariffs on $30 billion in goods imported from the U.S., effective February 4, 2025, when the U.S tariffs are applied. The list includes products such as orange juice, peanut butter, wine, spirits, beer, coffee, appliances, apparel, footwear, motorcycles, cosmetics, and pulp and paper. A detailed list of these goods will be made available shortly.

Minister LeBlanc also announced that the government intends to impose tariffs on an additional list of imported U.S. goods worth $125 billion. A full list of these goods will be made available for a 21-day public comment period prior to implementation, and will include products such as passenger vehicles and trucks, including electric vehicles, steel and aluminum products, certain fruits and vegetables, aerospace products, beef, pork, dairy, trucks and buses, recreational vehicles, and recreational boats.

The U.S. administration’s decision to impose tariffs will have devastating consequences for the American economy and people. Tariffs will upend production at U.S. auto assembly plants and oil refineries, raise costs for American consumers—at gas pumps and grocery stores—and put American prosperity at risk.

“These U.S. tariffs are plainly unjustified. They are detrimental to both American and Canadian families and businesses,” said the Honourable Dominic LeBlanc, Minister of Finance and Intergovernmental Affairs.

AUTHOR COMMENTARY

I have repeated a number of times in 2024 that tariffs would be detrimental to Americans, especially if Trump really starts ratcheting up the number, which is very possible since Mexico and Canada were quick to respond with their own measures.

And yet lost in the shuffle in all of this is that Americans WILL be forced to pay more as these measures are inflationary. The importer (the U.S.) pays the additional costs, not the exporter. We have already examined this before with a number of heads of major U.S. corporations saying they will pass on the additional costs incurred onto the consumer; which you can read about in this report I did last year: “A Number Of Companies Say They Will Pass Higher Prices Onto Consumers Because Of Trump’s Tariffs.”

Since then, more companies have said something similar. Walmart CFO John David Rainey said in an interview with Fox on November 20th: “Tariffs are going to be inflationary, there’s no disputing that.”

ClearValue Tax, Brian Kim, CPA, has an excellent video that simply explains how a tariff works. It’s a tax on importers that we will end up paying for, just as simple as that.

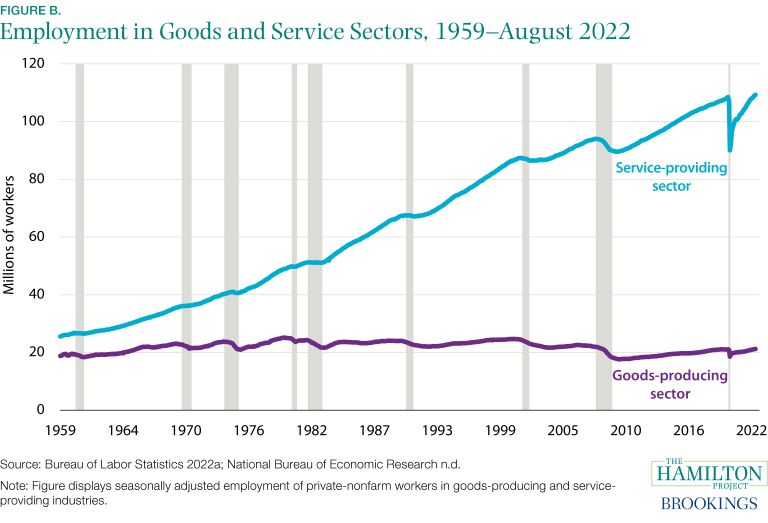

Furthermore, World Affairs in Context shared a similar sentiment and facts that I have tried to articulate a number of times before to readers and others should the conversation arise: we don’t have the infrastructure and manufacturing in place, period.

Naysayers will immediately say that globalization is hurting us (and it is) and that we need to bring jobs back to the U.S. The problem is that this country simply does not have the infrastructure and manufacturing capacity, and one cannot simply flip a switch and turn this country into a production juggernaut again overnight.

The U.S. is a service and consumer-based economy. The country manufactures very little anymore. Only 11% of the nation’s GDP in 2023 was in manufacturing. This country is an importer nation.

I want better paying jobs in this country; I wish this country’s politicians and crooked corporations would not have sold us out for cheap labor elsewhere; but imposing self-defeating measures by drastically increasing protectionist measures will only make the problem worse. Free trade and competition allows for cheaper prices: this is monetary theory and economics 101.

I have warned for months that Trump’s policies will drastically increase the prices of everything, and now you are reading it straight from the heads of these different companies across different sectors. On top of this, one must also consider that he will be cutting the corporate tax rate from 21% to 15% while interest rates move lower. This will allow corporations to pay even less while we are forced to pay substantially more, thereby pushing stock prices higher.

In truth, by biblical definition, we are a nation run by fools; whether it’s Trump, Biden, Harris, Obama, Bush, etc.

Ecclesiastes 10:12 The words of a wise man’s mouth are gracious; but the lips of a fool will swallow up himself. [13] The beginning of the words of his mouth is foolishness: and the end of his talk is mischievous madness. [14] A fool also is full of words: a man cannot tell what shall be; and what shall be after him, who can tell him? [15] The labour of the foolish wearieth every one of them, because he knoweth not how to go to the city.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.