"BRICS Pay" Blockchain Payment System To Trade CBDCs Grows In Popularity, Founder Says He Wants To Make 'Cashless Seamless Payments Around The World'

He emphasized that “we create a new principle architecture of payment infrastructure, […] we create a bridges between existing payment system.”

Off the heels of the latest BRICS summit in Rio de Janeiro, Brazil, the rapidly expanding economic bloc is also quickly growing an alternative payment model to existing Western and American institutions, as the world increasingly de-dollarizes and prioritizes its own national currencies for trade.

In steps BRICS Pay, a platform that provides a new alternative for BRICS members and partners, and even other non-member Western nations and citizens, to trade digital currencies and buy and sell in local currencies. The system, as explained by its founder, bridges existing financial systems such as Visa, Mastercard, SWIFT, and many others, along with central banks and instant transfer payment rails. BRICS Pay could facilitate central bank digital currencies (CBDC), including bank-to-bank and in commercial settings.

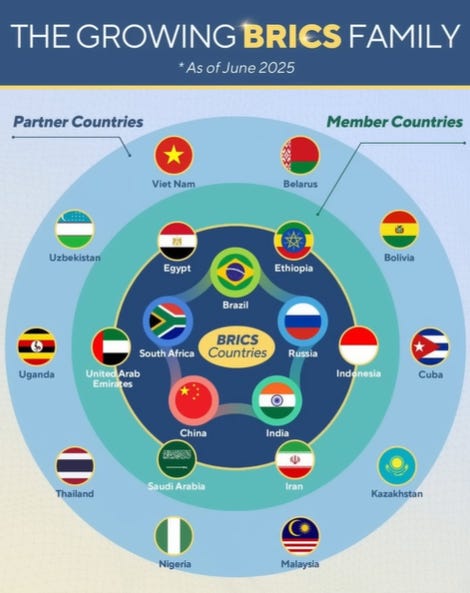

A common misconception about BRICS+ - which includes the original members Brazil, Russia, India, China and South Africa, and the latest additions with Iran, the United Arab Emirates, Saudi Arabia, Egypt, Ethiopia and Indonesia, not including the other partner countries - is many of its members and ‘apologists’ for the movement will often say that BRICS is not trying to be adversarial towards the West, but rather is a response towards American-driven bullying and exclusion; whereas BRICS still wants to maintain the agreed upon international order, but one that is not driven by a single hegemony.

This can be seen in BRICS’ Kazan Declaration in 2024 and the more recent Rio de Janeiro declaration signed earlier this month, whose statements are in many instances verbatim, word-for-word the same declarations the Western-driven G20 declares. The WinePress, and others such as Edward Slavsquat on Substack, have repeatedly demonstrated BRICS declared goals are virtually the same as the existing Western-led world order.

During the latest BRICS summit in Rio, a big emphasis this year was on finance.

BRICS leaders made it clear that a rumored unified currency is off the table, at least for now, and nations will prioritize their own local currencies in national trade.

Ambassador Tatiana Rosito explained that in terms of finance, some of the biggest priorities this year include “facilitating trade and finance, including through payment systems and greater integration of capital markets;” “to strengthen cooperation for the reform of the financial and monetary international system, including the traditional systems, the Bretton Woods institutions” (i.e. the World Bank); “to expand the use and dialogue on climate finance mechanisms,” among other things.

While not explicitly named, one of the tools to advance these goals is BRICS Pay. Though the project has been in relatively slow development for years, the fledgling alternative payment system is perhaps finally starting to show some teeth.

According to the website:

The global financial system, rooted in the Bretton Woods and Jamaica agreements, is undergoing significant transformation. The Bank for International Settlements (BIS) highlights the risks of fragmentation within the global monetary system, as unprecedented levels of global debt and unbacked money supply continue to rise.

At BRICS Pay, we are committed to ensuring equal access to financial services and technologies for all countries and individuals, empowering everyone to unlock their potential.Our mission is to connect diverse nations and people by providing seamless, fast, secure and affordable payment solutions worldwide.

BRICS Pay aims to collaborate with international and national payment systems, creating gateways and bridges to improve financial connectivity across borders. BRICS Pay also collaborate with local fintech companies to expand the payment infrastructure.

Our goal is to facilitate seamless transactions and strengthen cooperation among BRICS+ countries, ensuring that our payment solutions meet the modern needs of our partners and provide high security standards.

The website brags that it aligns with the United Nations’ 17 Sustainable Development Goals (SDGs) - something that was heavily emphasized in the recent Rio Declaration. “The technologies and principles of BRICS Pay are designed to support these objectives,” the website adds.

BRICS Pay was on full display last year in Russia when demo cards with QR codes on them were distributed in a quest to perform live trials. The cards were preloaded with 500 rubles.

The BRICS Pay website used to clearly display on its front page that their system could facilitate CBDCs and tokenized assets, as noted in prior WinePress reports, but for whatever reason it has been removed. The website originally said:

“BRICS PAY set benefits from a combination of traditional payment systems and new technologies such as central bank digital currencies (CBDC), decentralized finance, and tokenized assets (secured money). BRICS PAY is an expansion of payment options for companies and citizens of participating countries, as well as for the entire world and all existing or emerging payment solutions.”

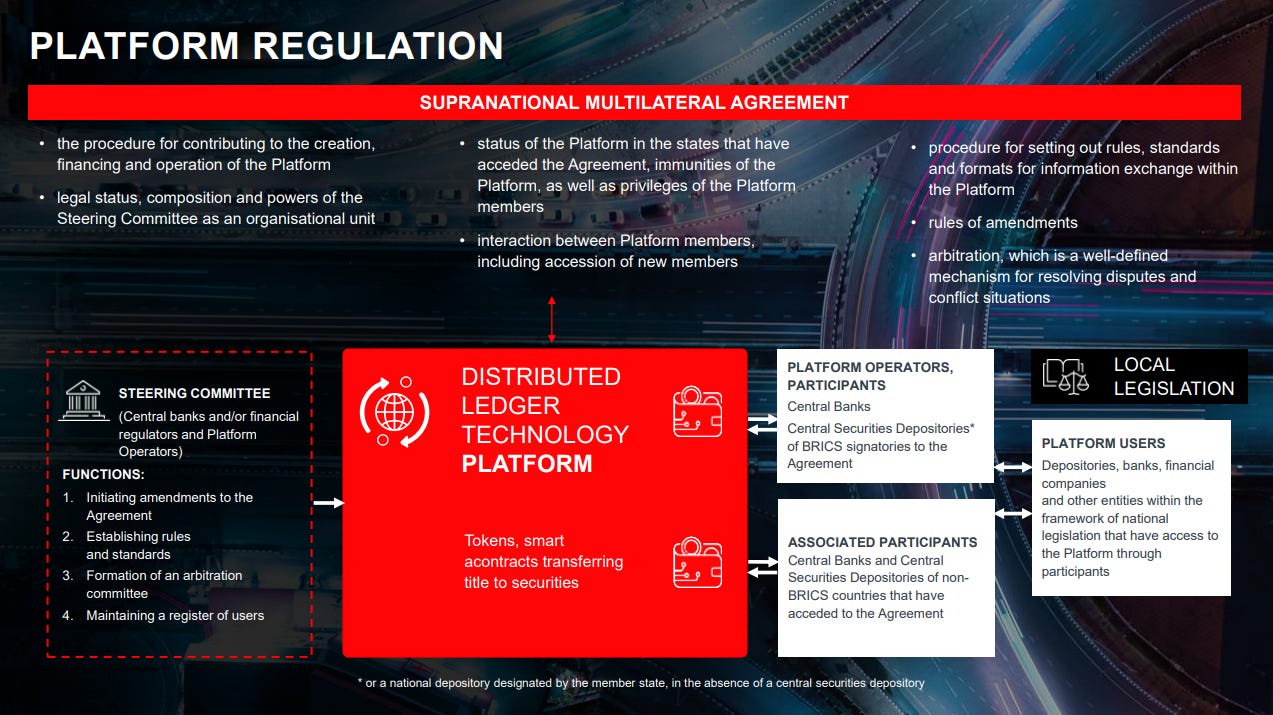

However, the website did publish a new working paper that explains how CBDCs and tokens would be traded in this new system called BRICS Clear, which could then integrate with BRICS Pay.

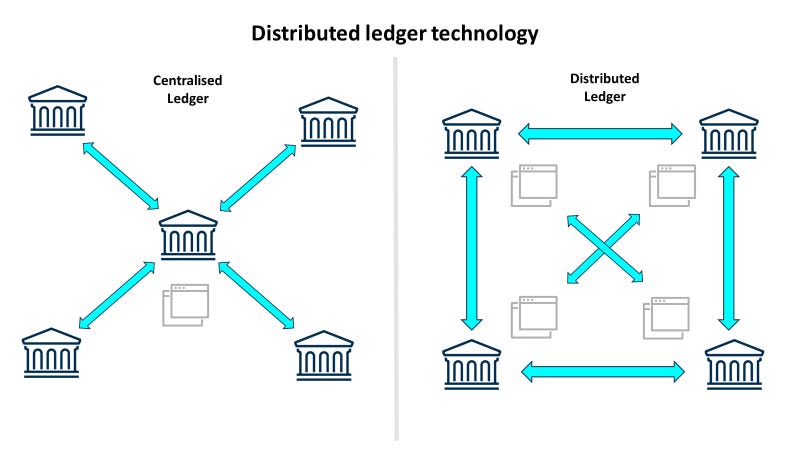

The paper references the use of distributed ledger technology (DLT), a platform that the Bank for International Settlements (BIS) is very much in favor of. Per a 2017 paper published by the BIS discussing DLT, the authors wrote:

“DLT refers to the processes and related technologies that enable nodes3 in a network (or arrangement) to securely propose, validate and record state changes (or updates) to a synchronized ledger that is distributed across the network’s nodes. In the context of payment, clearing, and settlement, DLT enables entities, through the use of established procedures and protocols, to carry out transactions without necessarily relying on a central authority to maintain a single “golden copy” of the ledger.”

In September of last year, Christopher Desch, an engineer and product architect at the New York Innovation Center at the New York Fed, and Henry Holden, an adviser at the BIS and who is on secondment with the New York Innovation Center, wrote in a piece explaining what tokenization is and its potential in various forms of the economy. They wrote:

“With tokenization, assets can be dematerialized without being immobilized. In other words, electronic assets can move around like pieces of paper, and would not need to be held in a single, centralized ledger like they are today. This flexibility would be augmented by another aspect of [distributed ledger technology] (DLT): “smart contracts,” or programmable rules that can automate processes. For securities, tokenization could be used to automate asset servicing, custody, and trustee tasks currently performed by intermediaries.”

In a recent interview with Think BRICS, founder of BRICS Pay, Andrey Mikhailishin, revealed some new details about his platform and why he and his team are doing this. The host reiterated that “we should say it one more time. It's not against anyone. It's an alternative.”

He emphasized that “we create a new principle architecture of payment infrastructure, […] we create a bridges between existing payment system.” This system integrates existing payment systems, he said. ”It will be such as a Visa, MasterCard, SWIFT, etc., as well as a national payment system.” “BricsPay is a project that connects all existing payment systems,” he clarified.

SWIFT Banking System To Launch CBDC And Tokenized Platform, Expected To Be Released By 2025 Or 2026

The founder went on to note that citizens from other countries outside of BRICS will be able to use this platform.

He went on to say that he wants to give “people to use their payment solutions, their national payment solutions, as well as Visa or MasterCard to make cashless seamless payments behind the world. […] We fully built an international infrastructure.”

Mikhailishin noted the collaboration between the Russian Central Bank and BRICS Pay. We have good relationships with Russian central bank. We have a negotiation. We have relationships with different Russian banks,” though he did note that because of Western sanctions levied against Russia it has made it harder at times to parse together an integrated system.

Mikhailishin also referenced BRICS Bridge, and while that and BRICS Pay are separate entities, he believes the two could eventually merge and BRICS Pay could be the infrastructure to transact CBDCs and tokenized assets.

“It was idea of Russian Minister of Finance. And after that, Russian central bank catch this project and some transformation. Today, BRICS Bridge is a project about central bank digital currencies to create some infrastructure to make payments on the central bank side.

“[…] And if we divide BRICS Pay and BRICS Bridge, BRICS Bridge project is a project for digital national currencies, for central bank digital currencies. And it's about payments between central banks of BRICS countries. BRICS Bridge projects, it's fully support cashless payments and as well as CBDC. Then when this project started in other countries.

“It's this project for business-to-business, bank-to-bank, and people-to-companies payments in retail everyday work. But I think maybe in the future, these projectors can make to operate together. Maybe BRICS Pay will be use infrastructure BRICS Bridge. But I think it's in the future.”

Host: “So there is a possibility they will be combined somehow?”

Andrei: “Maybe. Yeah. Yeah.”

Be that as it may, Mikhailishin did concede that the project is taking longer to implement than desired and that BRICS Pay does not have the vast resources as governments do, “but we don’t want any political engagement.”

AUTHOR COMMENTARY

Something that is constantly lost in the conversation about BRICS is how the collaborating nations are doing precisely what the Western-led order is doing. Multipolarity is global techno-feudalism. So many multipolarity apologists never bring this up, either because they like CBDCs and tokenized assets (meaning the total loss of financial freedom and liberty) and the United Nations, or because they are deliberately ignoring these things to paint BRICS like this ‘righteous’ entity. That doesn’t mean the U.S. is guiltless, FAR from it, I think we can all agree on that; but BRICS is not all roses and daffodils either. It’s digital enslavement by another name.

This was clearly exposed in my report on the Rio Declaration earlier this month.

It’s not like everyone from these nations wants this either, but their voices are suppressed and censored just as ours are increasingly being erased here in the West.

Meanwhile, for example, Russia is actively building a new all-in-one app that mirrors China’s surveillance state app WeChat. It does not take a genius to see that BRICS Pay will be integrated with that app.

The whole world is moving in one direction; and the U.S. is self-destructing so more resources can flow towards these nations in the East and West: this is how multipolarity is achieved. It’s not about “equity” or “respect for national sovereignty.” It’s about a one world government being reorganized into power blocks and unions, ruled by central banks and globalist institutions.

Of course, BRICS Pay and this rapid for tokenization that I continue to warn about, is getting us closer towards the eventual mark of the beast. We still have a ways to go yet and more dominoes to fall, but the end goal is blindingly obvious to those who can see.

Revelation 13:16 And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: [17] And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name. [18] Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six.

The digital chains are here around the world, masqueraded and brought in amidst World War III, manufactured plandemics and famines, forced onto populations that are scared, confused, and destitute.

1 Timothy 6:10 For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows.

Summer Sale: "The Lord Of Glory: The Detailed Guide To Who God Is" At Discounted Price For Limited Time!

Starting today and ending on July 31st, my book "The Lord Of Glory: The Detailed Guide To Who God Is" is on sale for 15% off its normal listing (prices will vary internationally).

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Thank you for providing the info and then the author’s commentary.

Appreciate you bringing in the Biblical insight.

Strange days that seem to be accelerating fast.

I recognize the Cloward Pivens strategy is being used by many so the plebs cannot keep up.

I am not surprised at what is being done, just expected it a few,or many years later.

Give me a Break that is what our bank cards already do, yes they want to make things better

Everything they always claim is in the name of Protection and Safety which is really Surface Haze for what they really want Power and Control.

Give a reason why the public should buy into and the snowflakes and cream puffs will jump right on that bandwagon. and I might add once they force it on us all, it will be seamless all right, as in you will SEAM, to be able to buy LESS.

In that moment it will be global ripoff and everyone will lose their shirts.