Global Inflation Is Forcing A Number Of Countries To Adopt Stablecoins, Bitcoin And Other Cryptos As Alternative Currencies

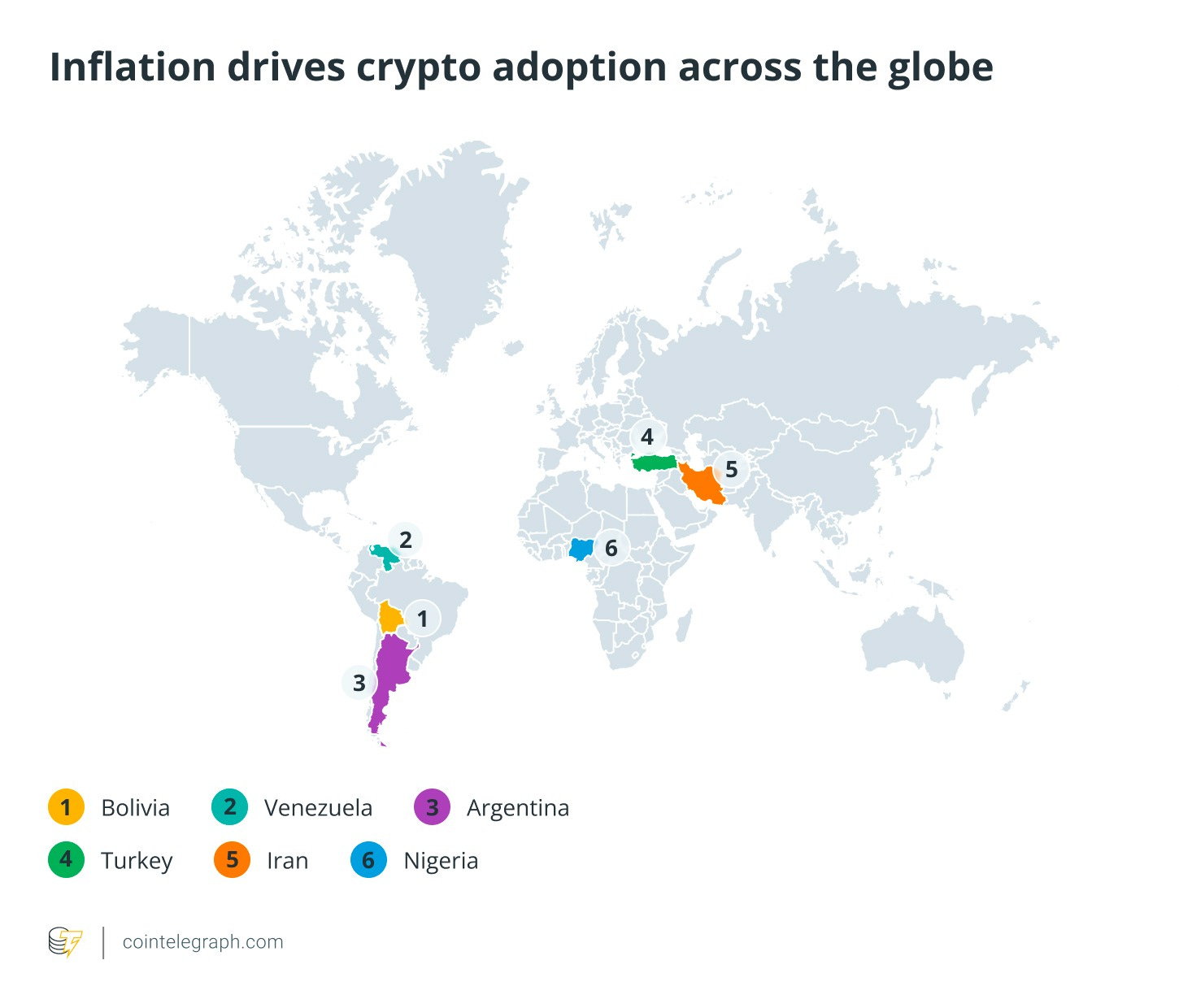

Bolivia, Venezuela, Argentina, Turkey, Iran, and Nigeria are key examples of early adopters due to inflation.

With the inflation bug biting everyone around the world, a number of countries’ populations are adopting alternative forms of digital money and tokens as their conventional fiat currencies hyperinflate, a trend that will only continue to spread.

Earlier this year, The WinePress highlighted remarks given by Chris Giancarlo, former chairman of the U.S. Commodity Futures Trading Commission (CFTC), who explained that as more fiat currencies around the world continue to be devalued and fail, they will be replaced with stablecoins, digital token representations of money and assets. Asset management juggernaut BlackRock has said something similar, predicting in a 2019 paper that they are expecting and pushing for explicit inflation in global economies as a way to accelerate the acceptance of digital, programmable money and tokenized assets.

Crypto outlet CoinTelegraph recently highlighted several case examples of countries adopting crypto, stablecoins and tokenized currencies in place of fiat currency, particularly in six countries: Bolivia, Venezuela, Argentina, Turkey, Iran, and Nigeria.

This summer, Bolivian shops started displaying Tether’s US dollar-pegged stablecoin, USDt. “Our products are priced in USDt (Tether), a stable cryptocurrency with a reference price informed daily by the Central Bank of Bolivia, based on the rate from Binance (a cryptocurrency trading platform),” a notice next to the tags read.

Bolivia’s economic minister, Jose Gabriel Espinoza, announced that banks will now be allowed to offer crypto custody, and that crypto will act as legal tender for savings accounts along with credit products and loans.

Venezuela is facing hyperinflation, with the worst inflation among all the nations on this list at 172%. The International Monetary Fund (IMF) is projecting a staggering 600% inflation rate by October 2026.

Because of this, Venezuela is converting to stablecoins. CoinTelegraph writes:

As a result, Venezuela ranks fourth in Latin America for value received in cryptocurrencies. Venezuelans received $44.6 billion in digital assets from July 2024 to June 2025, according to Chainalysis. According to The New York Times, President Nicolas Maduro has managed to “rewire Venezuela’s economy to stablecoins” with many Venezuelans referring to stablecoins as “Binance dollars.”

In a separate piece, CoinTelegraph how Venezuelans are using USDt to make purchases.

At the register, prices are posted in USD but settled in USDT at the day’s local P2P quote, most commonly the Binance P2P rate Venezuelans track on their phones.

The cashier (or condo treasurer) refreshes that quote and shows the total, and you scan a QR code that encodes the merchant’s Tron (TRC-20) address. Confirmation lands in seconds; typical network costs are low, though you do need a small [Tron] TRX balance to cover fees.

Merchants then choose: hold USDT as working capital, swap part of it to bolívars through an OTC/P2P desk for salaries and utilities or forward USDT upstream to suppliers.

In practice, the P2P rate is the operational benchmark because it reflects liquid order books and can be executed immediately. Therefore, apartment buildings, small shops and freelancers reconcile against it rather than the central bank’s rate or informal quotes.

This workflow (USD listing, P2P conversion, TRC-20 transfer) now supports everyday payments in the country.

[…] For many participants, the appeal is practical: With a phone and a basic wallet, they can hold, receive and send digital dollars without hunting for scarce cash.

[…] USDT is centrally issued and can be frozen in certain circumstances. To reduce exposure, merchants keep operating balances modest, spread funds across more than one wallet, avoid risky approvals and maintain simple off-ramps.

Nobel Peace Prize winner María Corina Machado has also been an advocate for Bitcoin. Machado is, of course, a strong ally and proxy of the United States and has close ties to the Trump administration - which is very favorable to Bitcoin, stablecoins and tokenized assets.

Argentina is the second-largest country in Latin America in terms of value received in cryptocurrency, at $93.9 billion in transaction volume. Though President Javier Milei has shown a friendliness towards crypto, the government has done much in the way of formally adopting digital assets as of yet.

Turkey has also faced high inflation, largely because President Recep Tayyip Erdoğan oddly believed that high interest rates leads to inflation, which then led to him lowering interest rates dramatically and causing inflation to spike. Though the pace is slowing down, it’s still high at 30%.

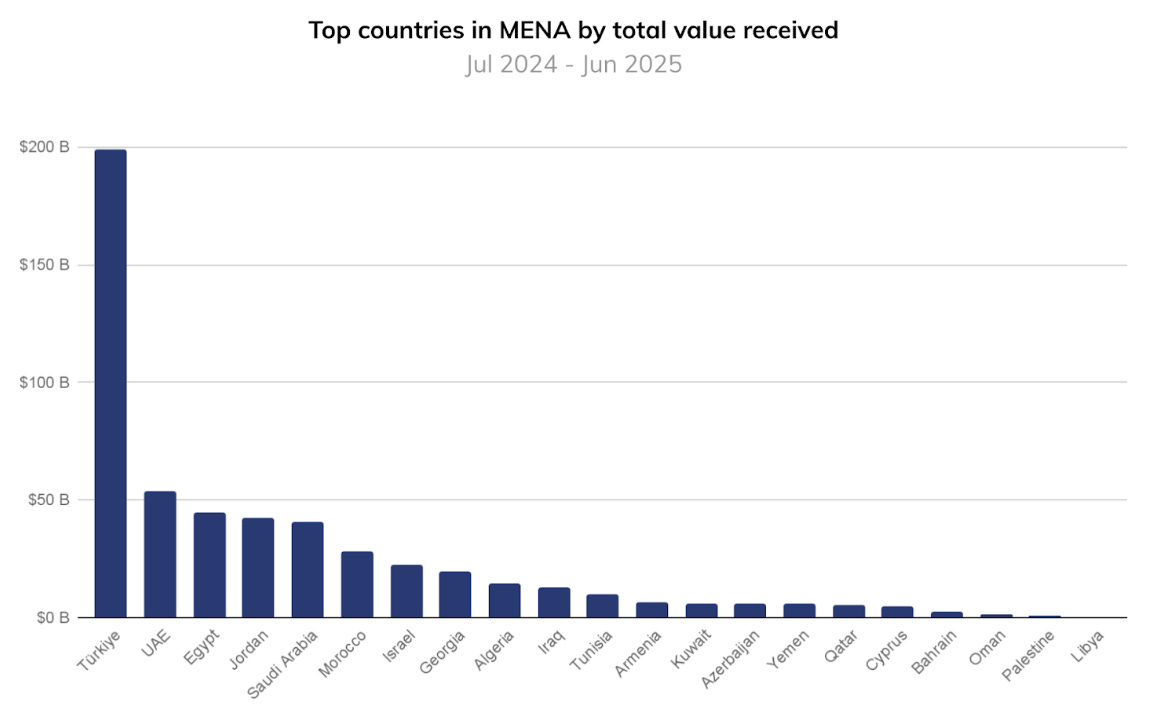

Turkey leads the Middle East and North Africa in crypto adoption, with $200 billion in crypto transactions from July 2024 to June 2025. As inflation lowers, the default preference for stablecoins is to steadily defer to altcoin trading.

“The timing of this altcoin surge coincides with broader regional economic pressures. It may reflect a desperate yield-seeking behavior among remaining market participants, who, faced with diminishing purchasing power and a more restrictive regulatory regime have embraced greater risk in pursuit of outsized returns,” Chainalysis explained.

Due to years of heavy sanctions, Iran has faced high and steady inflation, and it is on the rise again, reaching 45% in September. Because of this, crypto has been a way to circumvent and mitigate some of these sanctions.

Lastly, Nigeria has been facing inflation for years but as of recent it is steadily coming down. Nevertheless, Nigeria leads Sub-Saharan Africa in crypto transactions, receiving $92.1 billion in value from July 2024 to June 2025, Chainalysis reports. “Nigeria’s scale is tied not only to its population and tech-savvy youth, but also to persistent inflation and foreign currency access issues that have made stablecoins an attractive alternative,” the crypto report noted.

AUTHOR COMMENTARY

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

As I said in the intro to this article, the goal is hyperinflation around the world to force people to dump fiat currencies and go digital. Notice how gold and precious metals are not being revalued or even brought to the forefront. This is on purpose. It is antithetical to a central bank to put people back on a sound and stable monetary system. No, they want people enslaved to programmable, permissionable tokens that can be tracked and traced on blockchain ledgers. They might reintroduce tokenized gold as the anchor in name only, but it would still all be tethered back to tokens and digital chains.

I was recently asked about this in a recent interview (which will be posted soon) on how we will be onboarded to tokenization. This is how; and this is what BlackRock has explicitly said that they want: inflation, “helicopter money,” as to force people into CBDCs and tokenized assets.

This is what is going to happen in the U.S. and around the world. Countries will be forced to adopt stablecoins, CBDCs, or a combination of both.

The Lord Of Glory: The Detailed Guide To Who God Is – Available Now!

On one of his missionary journeys, the apostle Paul visited Athens, Greece, where he said he witnessed “the city wholly given to idolatry,” and who were “too superstitious” and worshipped a plurality of gods and deities, though the people acknowledged that there was still one God above all that was a mystery to them. When questioned by the philosophers …

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Truly tired of these demon control freaks. Will be interesting to see your interview..

The current money is near useless; so let's make imaginary money to fix the problem. Just make your own money and just add zero's so inflation stops and let's call it "inventa-money"