Bitcoin Mining Is Now Being Used To Heat Americans' Homes, As The Bitcoin And Crypto Corruption And Theft Continues

‘tRusT mE BrO, biTcIoN sOlVeS evEryThInG!’

The following report is from CNBC:

As winter’s chill settles in across the U.S., and electricity bills become a bigger budgeting issue, most Americans will rely on their usual sources of warmth, such as home heating oil, natural gas, and electric furnaces. But in a few cases, crypto is generating the heat, and if some of the nascent crypto heat industry’s proponents are correct, someday its use as a source within homes and buildings will be much more widespread.

Let’s start with the basics: the computing power of crypto mining generates a lot of heat, most which just ends up vented into the air. According to digital assets brokerage, K33, the bitcoin mining industry generates about 100 TWh of heat annually — enough to heat all of Finland. This energy waste within a very energy-intense industry is leading entrepreneurs to look for ways to repurpose the heat for homes, offices, or other locations, especially in colder weather months.

During a frigid snap earlier this year, The New York Times reviewed HeatTrio, a $900 space heater that also doubles as a bitcoin mining rig. Others use the heat from their own in-home cryptocurrency mining to spread warmth throughout their house.

“I’ve seen bitcoin rigs running quietly in attics, with the heat they generate rerouted through the home’s ventilation system to offset heating costs. It’s a clever use of what would otherwise be wasted energy,” said Jill Ford, CEO of Bitford Digital, a sustainable bitcoin mining company based in Dallas. “Using the heat is another example of how crypto miners can be energy allies if you apply some creativity to their potential,” Ford said.

It’s not necessarily going to save someone money on their electric bill — the economics will vary greatly from place to place and person to person, based on factors including local electricity rates and how fast a mining machine is — but the approach might make money to offset heating costs.

“Same price as heating the house, but the perk is that you are mining bitcoin,” Ford said.

A single mining machine — even an older model — is sufficient. Solo miners can join mining pools to share computing power and receive proportional payouts, making returns more predictable and changing the economic equation.

“The concept of using crypto mining or GPU compute to heat homes is clever in theory because almost all the energy consumed by computation is released as heat,” said Andrew Sobko, founder of Argentum AI, which is creating a marketplace for the sharing of computing power. But he added that the concept makes the most sense in larger settings, particularly in colder climates or high-density buildings, such as data centers, where compute heat shows real promise as a form of industrial-scale heat recapture.

To make it work — it’s not like you can transport the heat somewhere by truck or train — you have to identity where the computing heat is needed and route it to that place, such as co-locating GPUs in environments from industrial parks to residential buildings.

“We’re working with partners who are already redirecting compute heat into building heating systems and even agricultural greenhouse warming. That’s where the economics and environmental benefits make real sense,” Sobko said. “Instead of trying to move the heat physically, you move the compute closer to where that heat provides value,” he added.

Why skeptics say crypto home heating won’t work

There are plenty of skeptics.

Derek Mohr, clinical associate professor at the University of Rochester Simon School of Business, does not think the future of home heating lies in crypto and says even industrial crypto is problematic.

Bitcoin mining is so specialized now that a home computer, or even network of home computers, would have almost zero chance of being helpful in mining a block of bitcoin, according to Mohr, with mining farms use of specialized chips that are created to mine bitcoin much faster than a home computer.

“While bitcoin mining at home — and in networks of home computers — was a thing that had small success 10 years ago, it no longer is,” Mohr said.

“The bitcoin heat devices I have seen appear to be simple space heaters that use your own electricity to heat the room ... which is not an efficient way to heat a house,” he said. “Yes, bitcoin mining generates a lot of heat, but the only way to get that to your house is to use your own electricity,” Mohr said.

He added that while running your computer non-stop would generate heat, it has a very low probability of successfully mining a bitcoin block.

“In my opinion, this is not a real opportunity that will work. Instead it is taking advantage of things people have heard of — excess heat from bitcoin mining and profits from mining — and is giving false hope that there is a way for an individual to benefit from this,” Mohr said.

But some experts say more widespread use of plug-and-play, free-standing mining rigs, might make the concept viable in more locations over time. In the least, they say it is worth studying the dual use economic and environmental benefits based on the underlying fact that crypto mining generates significant heat as a byproduct of the computer processing.

“How can we capture the excess heat from the operation to power something else? That could range from heating a home to warming water, even in a swimming pool. As a result, your operating efficiency is higher on your power consumption,” said Nikki Morris, the executive director of the Texas Christian University Ralph Lowe Energy Institute.

She says the concept of crypto heating is still in its earliest stages, and most people don’t yet understand how it works or what the broader implications could be. “That’s part of what makes it so interesting. At Texas Christian University, we see opportunities to help people build both the vocabulary and the business use feasibility with industry partners,” Morris said.

Because crypto mining produces a digital asset that can be traded, it introduces a new source of revenue from power consumption, and the power source could be anything from the grid to natural gas to solar to wind or battery generation, according to Morris. She cited charging an electric vehicle at mixed-use buildings or apartment complexes as an example.

“Picture a similar scenario where an apartment complex’s crypto mining setup produces both digital currency and usable heat energy. That opens the door to distributed energy innovation to a broader stakeholder base, an approach that could complement existing heating systems and renewable generation strategies,” Morris said.

There are many questions to explore, including efficiency at different scales, integration with other energy sources, regulatory considerations, and overall environmental impact, “but as these technologies evolve, it’s worth viewing crypto heating not just as a curiosity, but as a small window into how digital and physical energy systems might increasingly converge in the future,” Morris said.

Testing bitcoin heat in the real world

The crypto-heated future may be unfolding in the town of Challis, Idaho, where Cade Peterson’s company, Softwarm, is repurposing bitcoin heat to ward off the winter.

Several shops and businesses in town are experimenting with Softwarm’s rigs to mine and heat. At TC Car, Truck and RV Wash, Peterson says, the owner was spending $25 a day to heat his wash bays to melt snow and warm up the water.

“Traditional heaters would consume energy with no returns. They installed bitcoin miners and it produces more money in bitcoin than it costs to run,” Peterson said. Meanwhile, an industrial concrete company is offsetting its $1,000 a month bill to heat its 2,500-gallon water tank by heating it with bitcoin.

Peterson has heated his own home for two-and-a-half years using bitcoin mining equipment and believes that heat will power almost everything in the future. “You will go to Home Depot in a few years and buy a water heater with a data port on it and your water will be heated with bitcoin,” Peterson said.

AUTHOR COMMENTARY

The energy consumption for Bitcoin mining is usually overshadowed by the absurd energy it takes to operate these massive AI data centers and battery factories, but Bitcoin is right up there as well.

So now people can have their homes heated by computers that produce Ponzi scam coins; a coin backed by nothing other than tribal-cultist hopium, government and BlackRock insider trading/pump and dumps, and the warmth the CPUs produce. Winning. What a clown world we live in now.

I plan to talk more about Bitcoin and its origins in continuing series of reports on tokenization, but I think Bitcoin should be called BitCON. It’s such a scam; and last month Bitcoin got massively rugged again along with other cryptos, amounting to the largest crypto crashes ever so far.

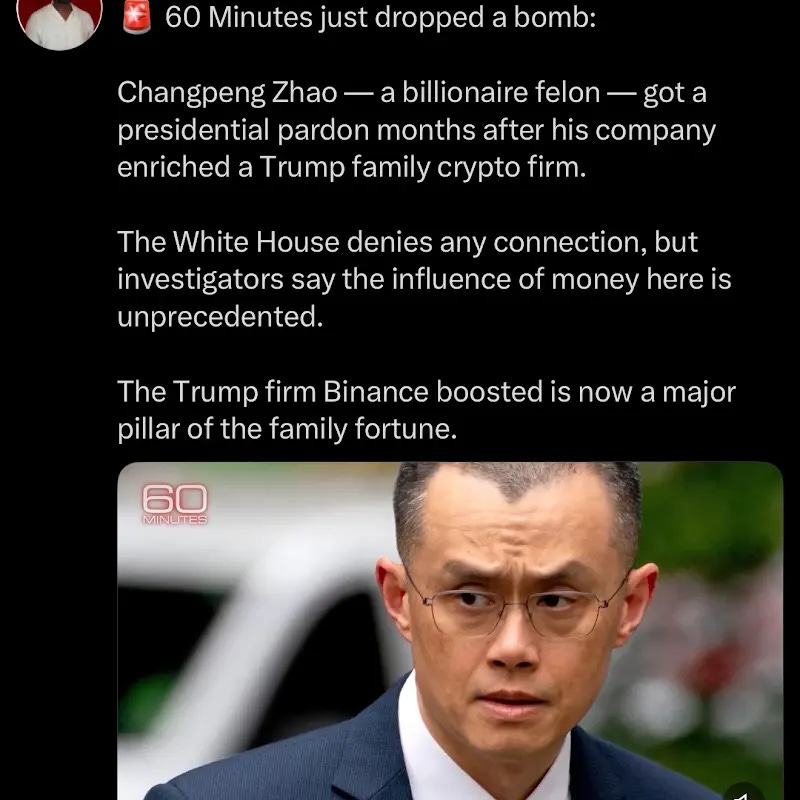

Of course, this was fueled by tweets by Trump announcing heavy tariffs on China. There was very clear evidence of insider trading up to the minute before Trump made the post. Of course, after chaos ensued over that weekend, Trump then announced the tariffs were off and stocks rose on the news. It was all a giant pump and dump scheme.

But if you recall, Trumpenstein and his gang did this earlier this year following the rollback of his Liberation Day tariffs, and the stock market rubber-banned so fast that markets had some of their best days ever in history, and then celebrated with his rich friends in the White House on the billions of dollars they just made in an afternoon.

It helps that he and his sons manage crypto firms, so they get to scalp more money from the top from these crashes they help stimulate.

Meanwhile, Trump is pardoning a known crypto and stablecoin scammer who has embezzled and stolen billions from people. Yet Trump then denies he even knows the guy he pardoned, even though Changpeng Zhao’s company benefits Trump’s World Liberty Financial and his stablecoin USD1.

Ecclesiastes 5:8 If thou seest the oppression of the poor, and violent perverting of judgment and justice in a province, marvel not at the matter: for he that is higher than the highest regardeth; and there be higher than they.

Bitcoin is twofold: a wealth transfer Ponzi scheme, and a sandbox experiment to get the masses used to cryptocurrency, blockchain, digital wallets, and programmable digital assets and tokenization.

Do you really think the government and central banks are going to allow the peasantry to operate an alternative currency and economy without their involvement? Yet this strange cult continues to come back for more even after they get liquidated and lose it all. It’s incredible.

Proverbs 23:4 Labour not to be rich: cease from thine own wisdom. [5] Wilt thou set thine eyes upon that which is not? for riches certainly make themselves wings; they fly away as an eagle toward heaven.

Larry Fink of BlackRock last year lauded the creation of the Bitcoin ETF would pave the way for broader tokenization.

“Let me be clear: ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset. To me, this is where we believe it’s going. […] These are technological changes that can allow us to move forward.

“[…] As I said, these are just stepping stones towards tokenization. And I really do believe that this is where we’re going to be going. We have the technology to tokenize today.

“Think about this: if you had a tokenized security, and you have a tokenized identity, you Andrew [Ross Sorkin], the moment you buy or sell an instrument on a general ledger that is all created together – you want to talk about issues about money laundering and all that; this eliminates all corruption by having a tokenized system.”

‘tRusT mE BrO, biTcIoN sOlVeS evEryThInG!’

Bitcoin was always a scam and Mr. Monopoly is laying it out for you in plain terms.

It’s tokenized dialectics: warmed by your own enslavement.

The Lord Of Glory: The Detailed Guide To Who God Is – Available Now!

On one of his missionary journeys, the apostle Paul visited Athens, Greece, where he said he witnessed “the city wholly given to idolatry,” and who were “too superstitious” and worshipped a plurality of gods and deities, though the people acknowledged that there was still one God above all that was a mystery to them. When questioned by the philosophers …

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

The whole idea of using Bitcoin mining heat for homes sounds clever on the surface, but you're absolutely right about it being another way to normaliz crypto infrastructure. The timing of these pump and dump schemes is no coincidence, especially with all the insider trading around Trump's tariff announcements. It's wild how people keep falling for the same patterns, losing money and then coming back for more. The tokenization angle is what really concerns me becaus it's all moving toward total financial control.

Nick Szabo created Bitcoin

I did my research