CBDC: Mastercard Releases Framework To Build European Union Digital Identity Wallet, Plans To Merge Driver's License With Wallet

"From accessing government services to protecting consumers online, digital identity will soon touch every part of our lives. The success of this ecosystem depends on one crucial thing: trust."

Payment giant Mastercard said last week it wants people to embrace digital IDs and merge them with banking capabilities, as it helps with the soon release of the European Union Digital Identity Wallet as a great example, helping facilitate central bank digital currencies (CBDCs) and tokenized money and assets.

For background - in March, European Central Bank (ECB) Chair Christine Lagarde revealed that the digital euro, a CBDC, was set to launch in October, though the ECB admitted that many Europeans simply are not interested and therefore messaging campaigns will need to be created.

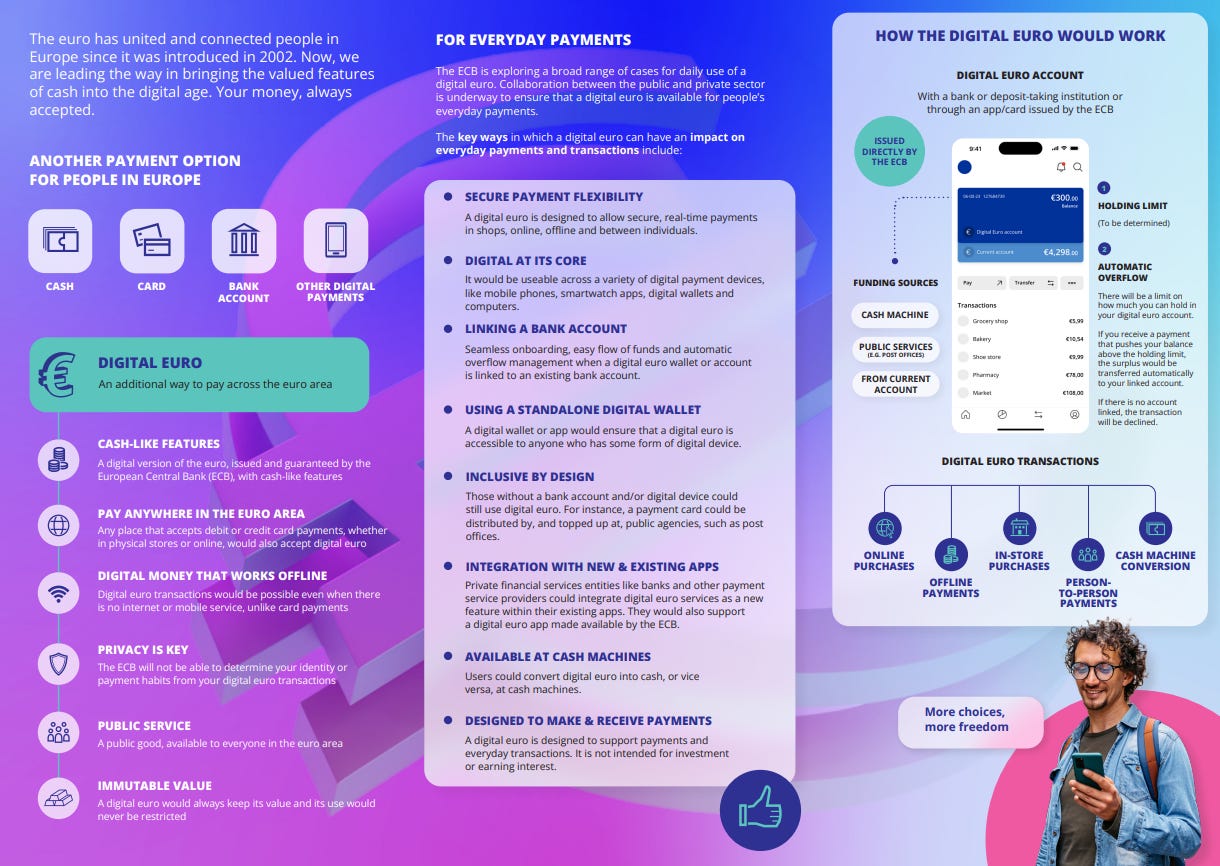

At any rate, the ECB acknowledged that in order for the digital euro to work, these new digital assets would not be stored on a digital ID wallet. “The Eurosystem would make available a digital euro app which would act as a uniform point of entry with a homogeneous look and feel for any end user to access digital euro services.” Furthermore, the ECB explains, “providing this app would ensure that basic functionalities are available, as identified by consumer’s associations and market surveys, as well as features supporting digital inclusion and the needs of people with disabilities and low digital skills.”

On cue, a month later the European Union voted on the creation of a new digital ID system. Commissioner Theiry Breton said, “Now, we have the digital identity wallet; we have to put something in it.” He presumably was referring to CBDCs and tokenized assets.

According to the European Commission,

“EU Digital Identity Wallets will provide a safe, reliable, and private means of digital identification for everyone in Europe. Every Member State will provide at least one wallet to all its citizens, residents, and businesses allowing them to prove who they are, and safely store, share and sign important digital documents.

“EU Digital Identity Wallets will make it possible. It will be a secure and easy way for European citizens, residents and businesses to prove who they are when accessing digital services.

“The wallets will enable you to safely request, store and share important digital documents about yourself and electronically sign or seal documents.

“Obtaining a new bank account, enroll in a university abroad, or applying for your next dream job will be as easy as it is secure. And your privacy will always be respected; you control what data is shared and who gets to use it.

“The European Digital Identity Framework entered into force in May 2024. Each Member State will offer at least one version of the EU Digital Identity Wallet, built to the same common specifications, by 2026.

In a blog post published on August 4th, Mastercard revealed that they aiding the ECB in launching the EU Digital ID Wallet. The company detailed how it is working to secure “tokenizing our payment credentials and integrating them” into the wallets, and “to build a secure and consistent global identity ecosystem,” along with cracking down on identity fraud and theft.

From the press release:

Whether opening a bank account, accessing government services or buying age-restricted goods online, people are often asked to verify basic details like age or location. Yet too often, this process is slow, confusing or invasive. It shouldn’t be that way.

Today, identity verification should be as quick, simple and trustworthy as tapping a card to pay.

That’s why momentum is building around a more streamlined, privacy-centric approach to identity in Europe. With over 500 million citizens accessing everything from financial services to government portals, there’s a clear need for a trusted, consistent way to prove who we are- digitally and securely. That is the current vision behind the European Digital Identity (EUDI) Wallet designed to deliver it. By 2030, the European Commission expects up to 80% of EU citizens could use it for everyday tasks like renting a car, signing a lease or verifying age online as a seamless alternative for secure authentication (SCA) and more.

At Mastercard, we are working to support this evolution. We believe digital identity should feel as natural and reliable as making a payment. Just as we’ve helped make payments simple and secure worldwide, we’re bringing that same approach to Europe’s digital identity ecosystem — starting with ensuring age verification works smoothly and protects everyone.

Our collaboration with identity innovators like Lissi is focused on securely tokenizing our payment credentials and integrating them into EUDI Wallets. This effort supports a trusted, interoperable digital identity ecosystem across Europe and aligns with our broader strategy to unlock the full potential of the EUDI infrastructure. By doing so, we aim to integrate card-based payments into EUDI wallets, harmonize strong customer authentication (SCA) and support enriched transactions that combine payment credentials with verified attributes such as age, student status, or residency.

From accessing government services to protecting consumers online, digital identity will soon touch every part of our lives. The success of this ecosystem depends on one crucial thing: trust.

In a 2024 blog post, Dennis Gamiello, Executive Vice President for Identity Products and Innovation at Mastercard, also wrote of the benefits of digital ID verification.

“Let’s say you’ve just closed on your first home and want to order a bottle of champagne to celebrate. You’d place your item in your online basket as normal, and then be asked to confirm you’re old enough to make the purchase. In the background, Mastercard enables merchants to easily validate your age with your card issuer securely and without adding any unnecessary friction to your experience. Your card is enough.”

In 2022, Mastercard introduced a “smile to pay” system. “You can forget the clunkiness of taking your wallet out, or your devices out, or you cards out. You just do your shopping, you got to the checkout, and just pay with your face. It’s as simple as that,” said Ajay Bhalla, president of Mastercard’s Cyber & Intelligence business, member of the company’s global management committee.

When the individual’s face is scanned the data is then converted into a token linked to the payment card.

Last year, Mastercard’s competitor VISA introduced what they described as the “one card to rule them all,” allowing users to merge multiple payments sources into one single card or digital wallet. VISA revealed these cards will remove the unique serial numbers on the card, but instead with biometric data in a digital ID verification system.

Meanwhile, Mastercard has also been advocating for the use of mobile driver’s licenses (mBLs) and plans to merge those with digital wallets, too.

Reported by Biometric Update:

Mastercard Director of Product & Service Design Leonard Botezatu noted on a recent episode of Dock’s Identi3 podcast that he has joined the mDL Connections working group to contribute to “enhancing the educational dimension of mDLs from a product design standpoint.”

David Kelts, co-chair of the Secure Technology Alliance’s mDL Jumpstart Committee also joined Dock Labs CEO Nick Lambert in the discussion. He notes that at 5 million issued, mDLs now represent a large enough addressable market to be worth the work to accept them. The mDL Jumpstart Committee’s work on the mDL Connection resource is part of its work to raise adoption, which could eventually include half of the U.S. population.

Botezatu says being able to address those people, along with the ones across the Atlantic holding credentials built to the same standard, makes mDLs the natural step to follow “federated solutions” and ID document checks.

“To solve the fragmentation problem an international standard like the mDL ISO was needed. So from my point of view, standards drive harmonization, leading to a more kind of cohesive and accessible digital identity,” he explains. “This is the high level context in which a global company adopting an international standard like the mDL ISO has a huge benefit.”

Arizona became the first U.S. state in 2021 to allow mDLs on Apple iPhones and Apple Wallets.

Mobile ID World reported last week: “Currently, fourteen states support digital IDs on iPhone: Arkansas, Arizona, California, Delaware, Iowa, Louisiana, Mississippi, Missouri, New York, Oklahoma, Tennessee, Utah, Virginia, and West Virginia. The expansion follows the Transportation Security Administration’s approval of Apple Wallet digital IDs for domestic air travel verification.”

18 states are projected to issue standards-compliant mobile driver's licenses by mid-2025, the tech publication added.

AUTHOR COMMENTARY

Lest you have any doubts about the critical importance of digital IDs, Mastercard has once again alleviated any confusion: in order for the new world monetary system of tokenization, converting everything (including you) into a digital, tradeable asset stored on a blockchain, the digital IDs are tantamount to this.

Proverbs 29:5 A man that flattereth his neighbour spreadeth a net for his feet.

People such as Tony Blair have referred to this as the “great enabler” and it becomes part of your new existence, regardless of whether you even have a smartphone.

“This great enabler is digital identity. Not just a new piece of identity, but a new system for managing the information we share with government that is suited to the way we live our lives today. It is a digital wallet for every individual that gives them access to their documents (for example, driving license) and control of their data.

“The new ecosystem should make life easier for people and allow them to use their digital identity in many different contexts – not only to log in to government services but also to access commercial goods and services. This could enable them to prove they have a driving license when renting a car or verify their age online. It should also be accessible to everyone, regardless of whether they own a smartphone.”

Unfortunately, if you thought that throwing out your smartphone would stop the rollout, Blair and his globalist buddies say that matters not. I am not saying you shouldn’t toss your smart devices in the bin (that would be a wise decision for us all for a number of reasons), but it ultimately will not stop the digital IDs. The government and big-tech and healthcare systems have so much data on us anyway they could create one for us without our approval overnight.

Nevertheless, we understand just how important it is to have the masses have smartphones, smart watches and augmented glasses, and so forth; at least until implantables are mandated. But why else do you think here in the U.S. HHS Secretary Robert F. Kennedy Jr. wants people to wear wearable devices? Not just to track your vitals, but so your digital ID can be retroactively monitored and updated, and so you will have banking services right there in a jiffy.

Europe’s digital ID and CBDC rollout has been fairly quiet this year, at least in my opinion. I suppose now that it is less than two months away they don’t want to startle the public too much, but assuage them through heavy propaganda and artificial crises and incentives to get people to accept them.

The EU and the rest of the world, for the most part, are going the conventional CBDC route. The United States has gone the private route with stablecoins; which are still just CBDCs controlled by private corporations now given ‘bank’ status overseen by the Federal Reserve via the Treasury.

While it appears we still have a few years to go yet, we are increasingly getting closer towards the eventual mark of the beast.

Revelation 13:16 And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: [17] And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name. [18] Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six.

The Lord Of Glory: The Detailed Guide To Who God Is – Available Now!

On one of his missionary journeys, the apostle Paul visited Athens, Greece, where he said he witnessed “the city wholly given to idolatry,” and who were “too superstitious” and worshipped a plurality of gods and deities, though the people acknowledged that there was still one God above all that was a mystery to them. When questioned by the philosophers …

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Our motto: "Land of the free and home of the brave" should not be our motto anymore since it isn't true. "Land of the woke, home of the corrupt" suits it more. America isn't what it used to be and never will be again. I'm sure other countries say the same thing about theirs too

Those famous words "I'm from the government and I'm here to help" that came from Reagan.

Another words," I have the boot that will go on your neck". Who needs a yoke when we've got corrupt leaders